In the recent iFlock webinar titled "Navigating the Tides: Safeguarding Your Organization Through Third-Party Risk Management (TPRM)," leading industry experts Barbara Butler, iFlock, Morgan Cumiskey, Drata, and Tim Cunningham, Auditwerx delved into the third-party risk management (TPRM). Here are the key takeaways from the discussion.

Understanding TPRM:

Effective third-party risk management is not just a regulatory necessity; it's a strategic imperative. As businesses increasingly rely on external vendors for essential services, ensuring these partnerships do not expose the organization to undue risk is paramount. iFlock and its partners remain committed to guiding businesses to strengthen their cybersecurity frameworks against current and emerging threats. The urgency of implementing TPRM cannot be overstated.

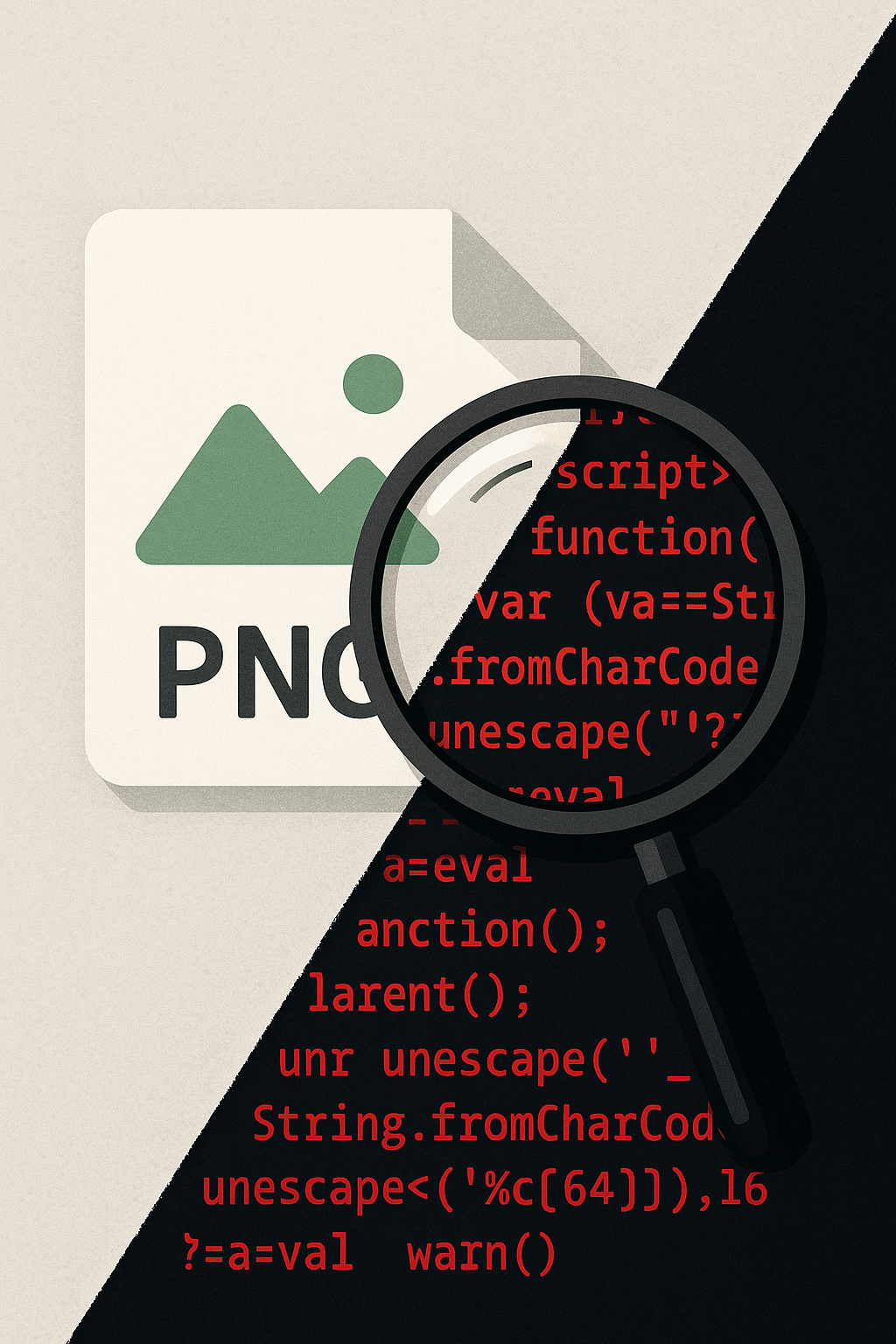

TPRM involves identifying, assessing, and mitigating risks associated with external entities that might disrupt an organization's environment. The webinar discussion focused on proactive management as essential to preventing potential data breaches and financial losses.

Real-World Impact:

Real-World Impact: To bring the concept of TPRM closer to home, let's consider the American Express Incident. This incident, which targeted American Express, serves as a stark example of the risks involved. It was a chilling reminder of the vulnerability of customer data, including social security numbers, names, and card details. The panel of experts stressed the importance of vigilance, early detection of unusual activities, and the implementation of robust cybersecurity measures like two-factor authentication and early tax filing to prevent identity theft. This real-world scenario underscores the criticality of TPRM in today's digital landscape.

Strategies for Effective TPRM:

The discussion also covered the lifecycle of TPRM maturity, from the initial stages of compliance to optimizing and scaling risk management processes. Experts emphasized the need for AI-driven tools to streamline vendor evaluations and reduce manual effort, enhancing both security and operational efficiency. They also highlighted the importance of continuous monitoring, regular audits, and proactive risk mitigation strategies. These practical insights can serve as a guide for organizations looking to strengthen their TPRM practices.

Risks of Inadequate TPRM Systems:

Organizations that neglect to develop a robust TPRM program expose themselves to significant risks, including:

- Data Breaches and Security Incidents: Without a mature TPRM process, companies may fail to identify security vulnerabilities in their third-party vendors, leading to data breaches that can compromise sensitive customer information and intellectual property.

- Financial Losses: Inadequate oversight of third-party vendors can result in financial losses due to fraud, non-compliance fines, or operational failures. These incidents not only have immediate financial implications but can also require costly remediation efforts.

- Reputational Damage: Companies that experience third-party-related failures may suffer damage to their brand and reputation. The public's perception of a company's ability to manage third-party risks can influence customer trust and loyalty.

- Regulatory and Legal Consequences: Many industries are subject to stringent regulatory requirements concerning third-party risk management. Companies that fail to comply with these regulations can face legal penalties, fines, and other regulatory actions.

For organizations leveraging third-party services, developing a mature TPRM program is not optional but a critical requirement. Starting with foundational policies and moving towards optimized processes allows organizations to protect themselves against various risks associated with third-party engagements. Businesses are advised to regularly assess and improve their TPRM practices to safeguard their operations, reputation, and legal standing in an increasingly interconnected business environment.

Implementing TPRM Maturity Lifecycle Stages:

The TPRM maturity lifecycle can be divided into four distinct stages, each representing a progressive level of risk management sophistication and integration within the organization:

-

Start: At this foundational stage; organizations primarily focus on creating basic guidelines and frameworks for managing third-party risks. This typically involves developing initial policies, conducting rudimentary assessments, and establishing compliance with the most critical regulations. The goal is to set a baseline from which more refined practices can be developed.

-

Establish: Once the foundation is laid, organizations begin to structure their TPRM processes more formally. This includes standardizing assessment methodologies and integrating third-party risk management into the broader organizational risk framework. Companies at this stage are starting to see a more systematic approach to managing third-party relationships.

-

Manage: At the management stage, organizations have established TPRM processes and begin to manage third-party risks proactively. This involves continuous monitoring, regular reassessments, and the integration of TPRM into the enterprise risk management strategy. Companies at this stage are better equipped to respond quickly to changes in third-party risk profiles.

-

Optimize: The final stage of maturity focuses on refining TPRM strategies to maximize efficiency and effectiveness. This involves leveraging advanced technologies such as AI to automate monitoring and compliance checks, enhancing data analytics capabilities for better decision-making, and continuously improving processes to stay ahead of new risks.

Conclusion:

For organizations leveraging third-party services, developing a mature TPRM program is not optional but a critical requirement. Starting with foundational policies and moving towards optimized processes allows organizations to protect themselves against a wide range of risks associated with third-party engagements. Businesses are advised to regularly assess and improve their TPRM practices to safeguard their operations, reputation, and legal standing in an increasingly interconnected business environment.

Q&A Highlights

- Question: How do you prioritize risk when assessing multiple third-party vendors?

- Answer: Tim advised selecting vendors with a proven track record and robust security measures. He emphasized the importance of choosing 'best in breed' providers to mitigate security and operational risks.

- Question: What strategies do you use to develop contingency plans for unexpected third-party risks?

- Answer: The approach should be proactive rather than reactive. Confirming a vendor's operational longevity and track record before engagement is crucial to ensuring service continuity.

- Question: How do you assess the financial stability of third-party vendors?

- Answer: Regular audits and compliance checks are vital. For sectors like PCI (Payment Card Industry), it is critical to ensure that vendors maintain their attestation of compliance annually.

Stay tuned for more insights in our upcoming webinars, and join us to stay one step ahead in the dynamic landscape of cybersecurity risk management.

If you have questions about TPRM and if your organization is vulnerable, contact iFlock for a complimentary consultation.

Watch the full webinar recording.

Thank you to our partners:

Morgan Cumiskey, Drata

Tim Cunningham, Auditwerx

Subscribe To Our Newsletter

Get updates and learn from the best

More To Explore